Update: Incorrect IRS late-filing notices for Form 8955-SSA

The Internal Revenue Service mistakenly sent out late notices to retirement plan sponsors

On August 25, the Internal Revenue Service clarified issues regarding erroneous CP 283-C penalty notices sent re: apparently late filing of 2022 Form 8955-SSA.

The IRS confirmed that the issue was a programming glitch, which it fixed on August 23. However, it emphasized that Form 8955-SSA is filed with the IRS through the FIRE (Filing Information Returns Electronically) system, not the EFAST system used for the Form 5500.

IRS sent a newsletter regarding penalty notices dated before September 1, 2023.

On September 1, the IRS distributed a newsletter confirming that plan sponsors that filed timely and complete Forms 8955-SSA do not need to respond to penalty notices dated before Sept. 1, 2023. The IRS does not plan to contact the plan sponsor in such cases; rather, they provided this number - 877-829-5500 - for plan sponsors to call for further information.

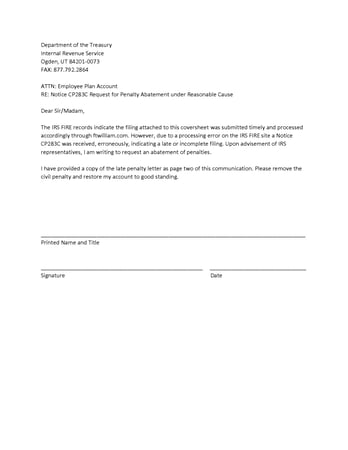

If you received a CP 283-C notice dated after September 1, 2023, or if you would like to submit a protective request for abatement of any late filing penalties, you may want to consider faxing this letter to the IRS.

Reminder to use FIRE to File Form 8955-SSA

The American Retirement Association (ARA), which has been in contact with the IRS regarding this issue, noted that the fact that Form 8955-SSA is filed with the IRS through the FIRE (Filing Information Returns Electronically) system and not the EFAST system is not widely known.

The IRS also reminded plan sponsors that Form 8955-SSA must be filed with the IRS, not with the Department of Labor through the EFAST2 system. If a Form 8955-SSA is filed in EFAST2, it will not be treated as timely filed by the IRS. Visit Form 5500 Corner for more information on filing Form 5500 series returns and Form 8955-SSA.

Please contact your Herbein pension plan consultant if you received a CP 283-C penalty notice or if you have questions regarding this article.

Article Contributed by Barry D. Groebel